A cat, Tess, and a splendid horse, Shiloh.

DRAWDOWN CALC HOW TO

I think we need to apply more science to the solutions-not just what they should be, but how to get them into the world.Ī: I do! A dog, Griffin, half German shepherd and half Dutch shepherd. Climate change is such an urgent and existential problem that I felt an obligation to stay engaged. I was drawn to Project Drawdown because it’s a science-based organization devoted to the solutions rather than just defining the problem. When I left NRDC, I was not quite ready to retire.

DRAWDOWN CALC PROFESSIONAL

I want to complement their expertise, which is very deep and very impressive, with some of my experience with how the policy arena works in its intersection with science.Ī: I have been a scientist working at the intersection of science and policy for more than 20 years. I went into it as a very deliberate professional decision after a number of years in academia because I wanted to be in a position to say, “This is what the science says, and based on what the science says this is what you should do.” Q: What is your role with the Project Drawdown Science team?Ī: I bring to Project Drawdown a very broad expertise and knowledge base, and I hope one of the values I offer is to help periodically identify some of the cross-connections and synergies that my teammates may not have yet considered. Here, Tina explains why Project Drawdown is the perfect next step in her long and illustrious career, describes how she once found herself clinging to a ship’s mast high above the ocean, vouches for the therapeutic value of punching clay, and more. Tina comes to Project Drawdown with more than two decades of experience in the environmental nonprofit arena, including with The Bay Institute and the Natural Resources Defense Council (NRDC). An environmental scientist with a background in cross-disciplinary research and engagement at the science/policy interface, she is passionate about applying science to benefit society. Tina Swanson joined the Drawdown Science team as a visiting scholar in June 2023.

DRAWDOWN CALC SERIES

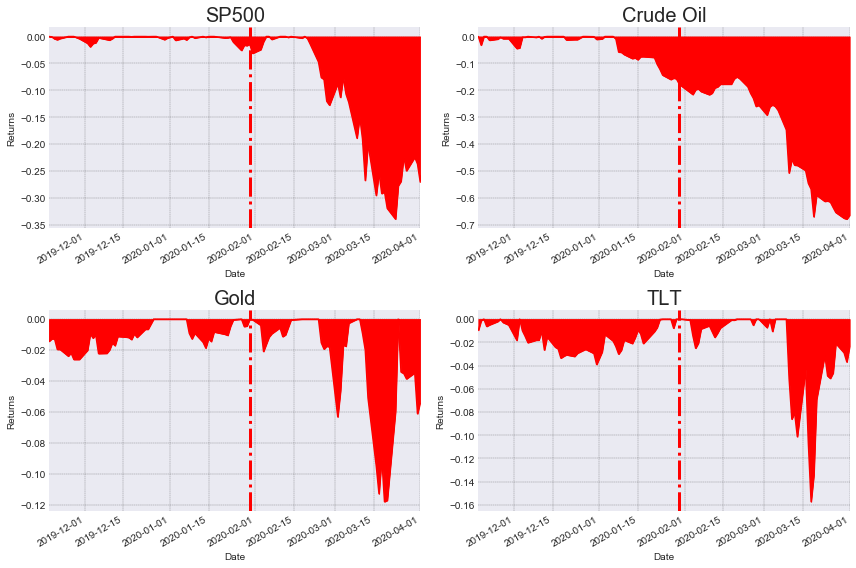

It is not possible to invest directly in an index and the compounded rate of return noted above does not reflect sales charges and other fees that investment funds and/or investment companies may charge.This article is the sixth in a series introducing the members of Project Drawdown’s science team. This includes the potential loss of principal on your investment. The actual rate of return on investments can vary widely over time, especially for long-term investments. It is important to remember that these scenarios are hypothetical and that future rates of return can't be predicted with certainty and that investments that pay higher rates of return are generally subject to higher risk and volatility. Savings accounts at a financial institution may pay as little as 0.25% or less but carry significantly lower risk of loss of principal balances.

The lowest 12-month return was -43% (March 2008 to March 2009). From Januto December 31 st 2021, the average annual compounded rate of return for the S&P 500®, including reinvestment of dividends, was approximately 11.3% (source: Since 1970, the highest 12-month return was 61% (June 1982 through June 1983). The Standard & Poor's 500® (S&P 500®) for the 10 years ending December 31 st 2021, had an annual compounded rate of return of 13.6%, including reinvestment of dividends. The actual rate of return is largely dependent on the types of investments you select. Rate of return The annual rate of return for this investment or savings account.

0 kommentar(er)

0 kommentar(er)